SPEND ANALYSIS & INSIGHTS

Effortlessly unify, categorise and analyse your spend data to get holistic spend visibility and reveal insights that streamline cost-saving strategies and achieve business goals.

Easily extract a wide range of data from diverse sources

Improve profitability and strategic decision-making

Maximise ROI from every dollar spent

SPEND ANALYSIS & INSIGHTS

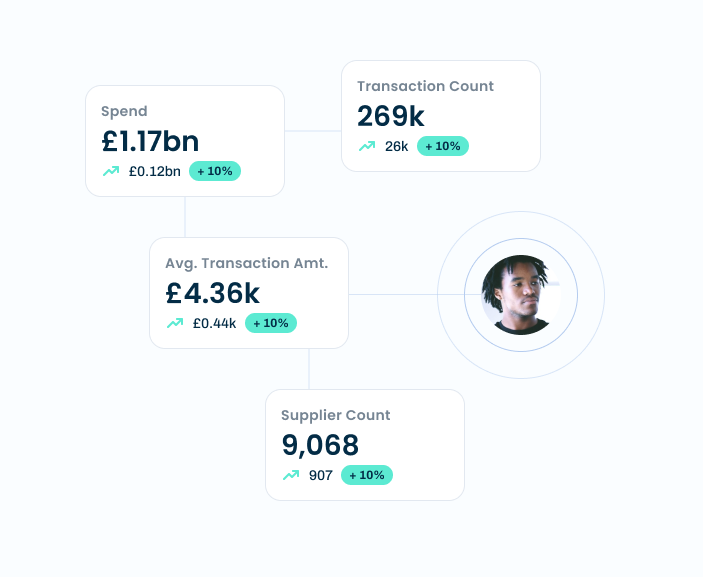

Effortlessly analyse and compare data to reveal insights that inform decisions to reduce risk, streamline cost-saving strategies and achieve business goals. Spendkey transforms vast amounts of unstructured and siloed data to provide holistic and granular insights into your direct and indirect spend, for greater visibility and control.

Easily extract a wide range of data from diverse sources

Improve profitability and strategic decision-making

Maximise ROI from every dollar spent

GEN AI SUPPORT

Empower teams across your organisation by arming them with direct actions to manage supplier conversations masterfully. Cassian AI unites Spendkey’s features with market intelligence to integrate your spending activities and automatically generate cost-saving recommendations. Get specific market insights to analyse supplier performance while automating everyday tasks, including creating and sending documents like RFPs or contract renewals.

Get a unified view of spend and effortlessly create customised savings strategies

Finely tuned recommendations and document templates to maximise your spend efficiency

Empower teams to uncover and shape opportunities with suppliers in one intuitive interface

CATEGORY MANAGEMENT

Get a comprehensive and granular view of spend by categories and subcategories, with the flexibility to classify capital and operating expenditures according to standardised or customised taxonomies. Spendkey combines machine learning with human expertise to accurately classify your spend into six levels, delivering superior spend visibility across cost categories to streamline sourcing strategies.

Customised spend classification

Improve supplier performance

Optimise sourcing strategies

DATA TRANSFORMATION

Effortlessly import data from any system and create a single source of truth across your organisation, with seamless integration and data mapping. Spendkey automates the consolidation, cleansing and categorisation of your data, enriching it with secondary sources for enhanced analysis. Free up time for strategic tasks and make better business decisions with data you can trust.

Automated data management

Unified view of enriched data

Empowered decision-making

SUPPLIER & CONTRACT INSIGHTS

Take charge of supplier conversations and control costs with Spendkey’s comprehensive spend and contract analytics. Our platform uncovers unstructured data from any document, equipping you with the insights required to secure better contracts, maximise savings and reduce risk. Analyse key supplier performance, ensure compliance and negotiate with confidence.

Negotiate better terms and rates

Eliminate non-performing suppliers

Bolster supply chain resilience

BUDGETING & FORECASTING AUTOMATION

Reduce manual effort and improve financial performance with Spendkey’s automated budgeting and forecasting. Import directly from Excel or start with last year's budget, then fine-tune as needed to ensure your budget aligns perfectly with your strategic financial goals. Reveal crystal-clear insights with reliable real-time variances and create precise forecasts based on historical spending data and market trends.

Define accurate budgets versus actuals and rolling forecasts

Make informed, data-led decisions

Save time and resources

IN-DEPTH ANALYTICS

Spendkey’s intuitive spend dashboards and in-built analytics deliver an extensive range of conventional and custom insights in a single, user-friendly interface. Use multi-dimensional spend cubes for detailed analysis, drill down into granular insights and create real-time forecasts for accurate scenario planning. Extend the advantages of real-time data beyond just accounts payable (AP) and finance.

Unified data visualisation

Customised reporting

Powerful, predictive insights

RISK & COMPLIANCE ASSESSMENT

Uncover unforeseen risks and improve compliance by harnessing historical spend data to identify unusual or fraudulent spending patterns. Spendkey’s AI identifies areas of non-compliance, enabling you to take action and effectively mitigate organisational risk. Receive alerts and reports when spending violates guidelines to eliminate mistakes and invoice fraud with forensic spend insights.

AI-detection of unusual spending patterns

Proactively mitigate organisational risks

Alerts and insights to eliminate fraudulent spend

DOCUMENT ANALYSIS

Effortlessly extract and analyse key data from diverse sources with Spendkey’s document analyser module to reduce risk, formalise strategies, and achieve business goals. Swiftly identify contractual nuances and ensure ethical compliance across your supply chain to safeguard your organisation's reputation and integrity while driving informed, responsible decisions.

Easily extract and analyse terms from various sources and documents

Quickly uncover hidden costs with contractual risk reviews

Safeguard your supply chain’s integrity and protect your reputation

GHG EMISSION TRACKING

Track and reduce greenhouse gas (GHG) emissions with AI and build a better future. Spendkey leverages data across your supply chain to provide insights on each of your supplier's Scope 3 carbon emissions, empowering you to take the necessary actions to reach your net zero emission goals.

Meet your sustainability targets with clean data

Track and reduce Scope 3 carbon emissions

Optimise emission reduction strategies